Sippy cups are likely to constitute an approximately US$ 8 billion global market in 2019, witnessing a moderate 4.4% growth over 2018. Delivering a wide selection of products in the baby care products category, the sippy cups market is slated for steady growth projections over the coming years.

According to a recently released market research intelligence by Future Market Insights, the global market for sippy cups continues to witness the dominance of Asian countries. Although a considerably high infant population and an equally surging growth rate of the same attribute for APEJ’s leading position in the global sippy cups marketplace, Europe is also represented as an important regional market.

Ecommerce Penetration Plays a Crucial Role in Market Growth

“While APEJ and Europe seem to maintain their global dominance in sippy cups market owing to the presence of a strong base for a majority of leading manufacturers and a relatively higher rate of infant population growth, it is the dramatically increasing Ecommerce penetration that is prominently boosting the growth of sippy cups market across urban areas of Asia and Europe,” explains a senior market research analyst at the company.

Request a Sample Report with Table of Contents and Figures: https://www.futuremarketinsights.com/reports/sample/rep-gb-8107

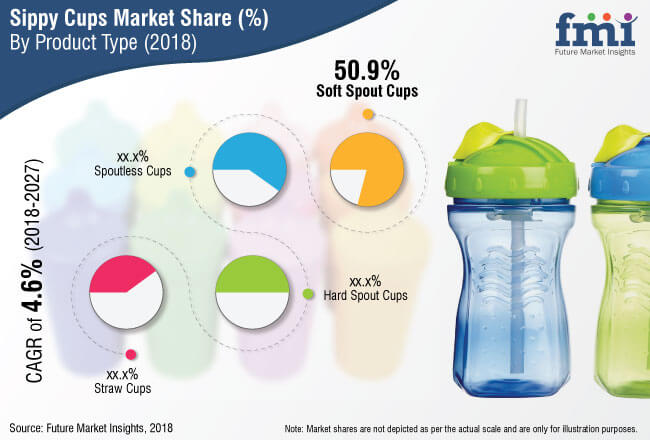

Moreover, discussing the top-selling product types segments in the sippy cups market, the analyst says, “Soft spout sippy cups secure the top-selling product position, whereas plastic remains a favored choice of material among manufacturers of sippy cups. Based on the age group of toddlers, sippy cups for 12-18 months are most attractive”.

When it comes to ranking the most popular distribution channel for sippy cups, the report highlights that supermarkets/hypermarkets continue to account for maximum sales of sippy cups. However, online sales are buckling up and may demonstrate faster growth over conventional retail channels over the course of upcoming years. Almost 20% of the total baby products sale occurs online (as of H1 2018), which clearly reflects the signs of an amplified share in the near future.

Munchkin Inc. has been dedicating heavy investment in online sales, with an additional promotional value through company blogs and informative articles on baby care products.

Customization and Innovation Trend Sippy Cups Market

- Innovative, convenient, versatile, and durable sippy cups are currently shaping the revenue growth of the sippy cups market.

- The report anticipates safety and additional features to emerge as the most sought-after parameters influencing purchasing decisions of consumer parents.

- Customization of sippy cups is identified to be a growing trend that manufacturers are capitalizing on, in recent years.

- Baby fashion has been a significant factor positively influencing product innovation and sales across the baby care category.

- Another factor likely to hold long-term influence on sippy cups market revenue growth is the growing number of strategic mergers and acquisitions across the juvenile durable goods category.

CollapseAndGo recently launched convenient on-the-go sippy cups – Collapsacup – targeting a broad range, from newborns to five years olds. These sippy cups, as are made from silicone, are bacteria-resistant, tasteless and odorless, and temperature-resistant.

Koninklijke Philips N.V., one of the major operators in the competitive landscape, is focusing on the diversification of an existing line of leak-proof, BPA-free sippy cups and bottles.

Preview Analysis Sippy Cups Market: Manufacturers Offering Customized Products to Beat Competition: Global Industry Analysis (2013 – 2017) & Opportunity Assessment (2018 – 2027): https://www.futuremarketinsights.com/reports/sippy-cups-market

Experts Recommend Limited Use of Sippy Cups

A number of pediatricians altercate the frequent use of sippy cups, as the overuse may eventually result in reliance on sippers, and an increased risk of cavities due to overexposure to sugars in the milk, juices, or formula inside. They also suggest that the dependence of toddlers on sippy cups may lead to sabotaging meal times and delayed speech development.

The American Academy of Pediatric Dentistry even recommends the transition from sippy cups to normal cups as early as possible, after the age of one year. These and more such concerns related to the increasing adoption of sippy cups are likely to hold a significant impact on the sales of sippy cups, says the report.

It is ideally suggested that sippy cups should be allowed only for travel use, and ordinary cups or mugs should be brought in as better alternatives as early as possible.

BPA-free Sippy Cups Continue to Attract the Interest of Investors

BPA has been in use for plastic bottles and baby sippy cups over the past decades. However, the US FDA officially prohibited the use of BPA (bisphenol A) from baby bottles and sippy cups (post-2012) – post the revelations made by the American Chemistry Council that BPA tends to leach into food and beverage products, including water, milk, and infant formula – subsequently passing on the traces into the consumer’s body. Research says that BPA traces may later even pose adverse health effects predominantly on the brain and behavior of toddlers and children.

This industrial chemical that mimics estrogen has thus been on the radar of sippy cups manufacturers and by now, the entire sippy cups market has traveled a paradigm shift to BPA-free sippy cups. As the consumer sector is witnessing a rapid influx of products labeled BPA-free, it is most likely that the focus of sippy cups and bottles manufacturers on the BPA trend will zoom in over the coming years. Material innovation in the BPA-free segment is anticipated to remain a highly notable trend shaping the competitive landscape of the sippy cups market, reports FMI.

However, although manufacturers of sippy cups and bottles have been taking into consideration the concerns over potentially hazardous health effects of BPA and thereby switching to an extensive range of similar-looking material alternatives, ongoing research continues to indicate that even ‘BPA-free’ may not be entirely safe, and have a certain set of health risks associated with it.

Our advisory services are aimed at helping you with specific, customized insights that are relevant to your specific challenges. Let us know about your challenges and our trusted advisors will connect with you: https://www.futuremarketinsights.com/askus/rep-gb-8107

Market Segmentation

On the basis of product type, the global sippy cups market is segmented into soft-spout cups, hard-spout cups, straw cups, and spout-less cups. The global sippy cups market is further segmented on the basis of the source. The source segment includes plastic, glass, stainless steel, and other sources, which include fabric, cotton, etc. The global sippy cups market is also segmented on the basis of potential end-users as 0-12 months, 12-18 months, 18-24 months, and 2 years & above. On the basis of sales channel, the global sippy cups market is on the basis of distribution which includes segmented into supermarket/hypermarket, convenience store, specialty store, and online store.