The global intermediate bulk container (IBC) liners market is likely to reach US$ 785.1 Mn by 2020-end, experiencing a minor blip due to the pandemic crisis. In spite of shortfalls in global trade, the market is expected to remain afloat due to high demand for essential goods and services.

Technological disruptions have characterized recent developments in the global packaging industry. Packaging solutions intended to facilitate bulk transportation and simultaneous economization of space have widened scope of the IBC liners market.

Furthermore, recyclable and sustainable materials are the center-stage for further market penetration. The French paper giant Ahlstrom, for instance, has been extensively using recyclable IBC liner solutions, thus enabling it to incur cost savings exceeding US$35,000 annually.

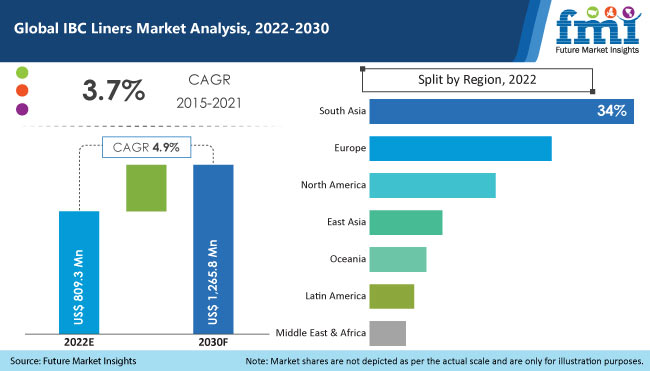

“Emerging markets across the Asia Pacific promise to generate potential revenue pools for IBC liner manufacturers, attributed to surging trade volumes in the wake of rapid industrialization and urbanization,” comments the FMI analyst.

Request a report sample with 268 pages to gain comprehensive insights at https://www.futuremarketinsights.com/reports/sample/rep-gb-12772

IBC Liners Market- Key Takeaways

- Global IBC liners market to expand at 5% CAGR through 2030, reaching US$ 1.2 Bn

- North America to retain market lucrativeness, East Asia likely to generate credible expansion opportunities

- Polyethylene liners to generate over 36% revenue share by 2021 owing to high degree of protection from external contamination

- Liquid packaging to emerge as the most lucrative segment by content type

- Aseptic packaging to acquire momentum, expanding at a positive CAGR through 2030

IBC Liners Market- Prominent Drivers

- Heightened need for cost optimization spurs adoption of efficient packaging solutions, catapulting IBC liners growth

- Credible growth potential lies across the chemical manufacturing segment, owing to increased demand for safe transportation of industrial solvents

- Heightened consumption of instant foods and beverage amid the pandemic crisis has accelerated IBC liners packaging solutions demand

For any Queries Linked with the Report, Ask an Analyst@ https://www.futuremarketinsights.com/ask-question/rep-gb-12772

IBC Liners Market- Key Restraints

- Composite IBC liners can create potential fire hazards upon breach, thus limiting their uptake across chemical manufacturing

- High initial capital expenditure is discouraging manufacturers from investing in IBC containers, thus restraining uptake of IBC liners

COVID-19’s Impact on IBC Liners Market

The COVID-19 pandemic ushered in a minor trough across the IBC liners market, owing to imposition of stringent lockdowns to contain the virus’s spread. However, the past few months have witnessed a resurgence, owing to high demand for essential products such as foodstuffs, functional beverages and pharmaceutical/nutraceutical products.

Amid fears of a second pandemic wave, prominent manufacturers are bracing for a possible downturn, prompting them to consolidate existing distribution networks, strengthen logistical and supply chains and cushion dependent industries from the possible revenue shortfalls.

As of March 2020, demand for frozen foodstuffs accounted for over six out of ten sales in France, and over half across Germany. Likewise, the Indian pharmaceutical industries registered an increase of over 10% in its exports. Therefore, adoption of IBC liners to ensure proper delivery has surged.

Hence, manufacturers are highly optimistic about a post-pandemic like resurgence in the ensuing months, keeping demand afloat.

Explore more about the IBC liners market, comprising 84 tables and 125 figures along with the table of contents. You will find detailed market segmentation on https://www.futuremarketinsights.com/toc/rep-gb-12772

Competitive Landscape

Prominent players operating in the global IBC liners market include Sealed Air Corporation, Amcor Plc, Packaging International BV, Hanlon Solutions Resource Inc., Brambles Industries Ltd., Arena Products Inc, Qbig Packaging B.V, Sealed Air Corporation and Palmetto Industries to name a few.

These players rely on new product launches, acquisitions, collaborations and mergers in order to enhance their penetration. Amcor PLC, for instance, collaborated with Nestle to launch the world’s first recyclable packaging solution for pet foods in September 2020, expected to yield 60% of environment footprint reduction.

Key Segments:

Capacity

- Up to 1,000 liters

- 1,000 to 1,500 liters

- Above 1,500 liters

Material Type

- Polyethylene

- LDPE

- LLDPE

- Polyamide (PA)

- Polypropylene (PP)

- EVOH

- Aluminum Foil

- Others (PVC, PET)

Thickness

- Up to 50 micron

- 50 to 100 micron

- 100 to 150 micron

- Above 150 micron

Content Type

- Powder & Granules

- Liquids

Filling Technology

- Aseptic

- Non-aseptic

End-use

- Food

- Edible Oil

- Dry Food

- Beverages

- Alcoholic

- Non-Alcoholic

- Chemicals

- Specialty

- Commodity

- Paints, Inks & Dyes

- Agricultural

- Pharmaceuticals

- Biopharmaceuticals

- Petroleum, Lubricants & Others

Region

- North America (U.S & Canada)

- Latin America (Brazil, Mexico & Rest of Latin America)

- Europe (Germany, Italy, France, U.K, Spain, BENELUX, Russia & Rest of Europe)

- East Asia (China, Japan & South Korea)

- South Asia (India, Thailand, Indonesia, Malaysia & Rest of South Asia)

- Middle East & Africa (GCC, Turkey, Northern Africa, South Africa & Rest of MEA)

- Oceania (Australia & New Zealand)