Registering decent consumption in retail and industrial sectors, cottonseed oil is gradually gaining ground in the food service provider segment as well. However, according to a new Future Market Insights’ study, the global revenue through cottonseed oil sales will continue to expand at a passive rate.

Towards the end of 2020, the global cottonseed oil sales are likely to cross the valuation of US$ 4 Bn and a majority of it will come from the sales observed in the Asia Pacific region, as reported by the FMI analyst.

At a mere below-3% year on year revenue growth estimated for 2019 and ahead, the global cottonseed oil landscape reflects a sluggish growth outlook at a global level. The report based on the cottonseed oil market analysis discusses in detail the top two pull factors associated with the declining growth rate of cottonseed oil market revenue.

Gossypol Content of Cottonseed Oil Accounts for the Demand on Lower Side

Although the demand for edible oils, especially cold-pressed variants, is observing a steady upsurge across the globe, cottonseed oil remains an exception. The report cites ample presence of a compound – gossypol – in cottonseed as the key factor responsible for the restricted consumption of cottonseed products, including cottonseed oil.

Examining the role of gossypol content of the cottonseed oil in limiting the global demand, a senior research analyst at FMI says, “Consumption of high concentration of gossypol compound has been proven to be potentially responsible for a few serious health issues, one of which includes suppressed male fertility. The other possible adverse effects of gossypol consumption include anorexia, apathy, impaired body weight gain, and severe weakness”.

“While constantly ongoing research is likely to result in lowering the toxicity levels of gossypol content in cottonseed, the overall growth of the demand for cottonseed and derived products such as cottonseed oil remains passive worldwide,” adds the analyst further.

Another strong factor restraining the sales of cottonseed oil is its neutral taste and indistinct flavor, unlike that of other edible oil competitors – as indicated by the FMI report.

China’s Lead Sustains APEJ’s Top Consumer Position in Cottonseed Oil Landscape

Asia Pacific (excluding Japan), the largest cottonseed producer and exporter – and the potential goldmine for leading F&B manufacturers, processors, packagers, and import-export stakeholders – offers a heap of business opportunities increasing the likelihood for businesses to thrive in this regional market. India and China currently hold an almost equal revenue share in the APEJ market for cottonseed oil; however, according to the report, China is witnessing moderate yearly growth in revenue and thus will reflect higher incremental opportunity in the market, in coming years. At present, China accounts for more than 40% share of APEJ’s revenue, closely trailed by India.

Regional and Local Market Players Hold Important Positions in Cottonseed Oil Market

The global landscape of cottonseed oil is characterized by the active presence of a large number of MNCs as well as regional players, of which the former account for around 50% market value share whereas the latter make up for nearly 30% share of the total market value.

The report closely examines significant players in the cottonseed oil market such as Cargill, Incorporated, Archer-Daniels-Midland Company, Wilmar International Ltd, The Nisshin OilliO Group, Ltd, Bunge Limited, and Louis Dreyfus Company B.V. Moreover, the competition tracking involves some of the important regional and local level companies, including Gabani Industries Ltd., Asha Cotton Industries, PYCO Industries, Inc., and Matangi Cotton Industries.

For Information On The Research Approach Used In The Report, Ask Analyst @ https://www.futuremarketinsights.com/ask-question/rep-gb-2363

Bonus: Exclusive Insights Drawn from the Segmental Analysis of Cottonseed Oil Market

By Nature

Conventional cottonseed oil continues dominance over the organic counterpart, with the former holding more than 90% market value share at a global level.

However, with a trending wave of organic ingredients, a considerable rise in the incremental opportunity for organic cottonseed oil is more likely to be seen in coming years.

By Raw Material

GM cottonseed oil is witnessing higher sales over non-GM cottonseed oil, attributed to wide acceptance of GMO-induced crop cultivation practices over the recent decades.

By End Use

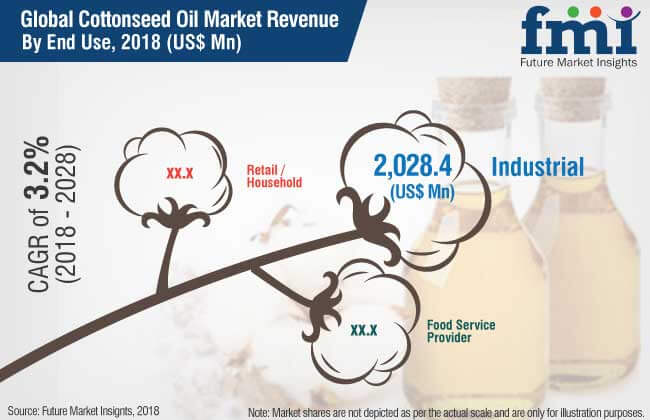

While industrial consumption of cottonseed oil continues to account for over half of the total market revenue, increasing opportunity in food service provider areas indicate a slight year over year growth of the latter.

By Packaging

Bulk packaging remains the favored type of packaging, compared to retail.

By Distribution Channel

B2B distribution is likely to remain the preferred one over B2C, reflecting a slightly higher attractiveness in terms of business growth.

About Food Market Division at FMI

Expert analysis, actionable insights, and strategic recommendations – the food & beverage team at Future Market Insights helps clients from across the globe with their unique business intelligence needs. With a repertoire of over 1,000 reports and 1 million+ data points, the team has analysed the food & beverage industry lucidly in 50+ countries for over a decade. The team provides end-to-end research and consulting services; reach out to explore how we can help.