As the world continues to deal with COVID-19 pandemic, the global market for medical loupes will decline during Q1 and Q2 of 2020 before returning to healthy growth in 2021, according to Future Market Insights (FMI) Yearly Medical Loupes Tracker.

The market has confronted a temporary setback in 2020 as supply chain disturbances have impacted revenue pool during early months and estimated product shipments have slowed the market mid-year.

That said, FMI estimates shipments of medical loupes to grow rapidly with CAGR of 5.4% from 2019 through 2029 as manufacturers and customers continue to invest in technology.

Request a report sample to gain more market insights @ https://www.futuremarketinsights.com/reports/sample/rep-gb-11128

Medical Loupes Market Size Study

- Sales of medical loupes to rise at 5.4% CAGR during 2019-2029

- Flip up loupes continue to capture leading revenue share, about 60%

- About 6 out of 10 medical loupes to be sold will have Galilean lens, given their high magnification level, minimal weight, and easy usage

- Adoption of medical loupes will remain high in surgical procedures through 2029

- Markey players to remain glued to offline channels for sales of medical loupes over following decade

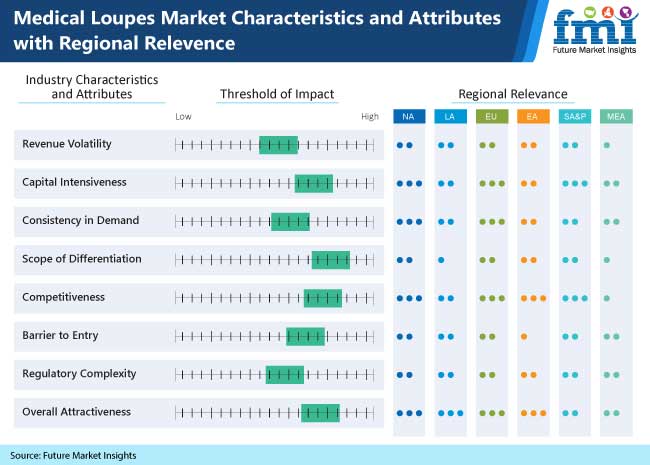

- Substantial sales to come from North America, markets in East and South Asia to experience tremendous growth

“Tech-advanced products are continuously required in medical device industry. Safe and high-tech medical equipment curb medical expenses for patients. Medical loupes are becoming increasingly advanced with regards to magnification power, product weight, and high powered optics. Tech-enabled transformation will enable market players to boost revenues, expand margins, and pursue new revenue lines with innovative business models,” says analyst at FMI.

COVID-19 Impact on Medical Loupes Market

The impact of COVID-19 pandemic has been negative on medical loupes market as several aesthetic procedures – liposuction surgery, breast implantation, and non-essential dental procedures – have been delayed due to pandemic-induced restrictions.

In order to free up limited space for individuals getting treated for COVID-19, hospitals have postponed – or canceled – several elective operations, particularly those considered non-urgent or non- essential.

Recent estimates have revealed that 15-30% of elective surgeries have been canceled in March 2020. Global market bariatric surgeries, implants, and cosmetic procedures will remain particularly vulnerable as these procedures are non-urgent, and can be delayed without significantly impacting quality of life.

That said, surgeries will return to pre-crisis rates by Q4 2020, with total numbers returning to pre-crisis levels by Q1 2022.

Medical Loupes Market – Competitive Intelligence

The global medical loupes market is fairly consolidated, wherein leading players are highly focused on developing innovative products to broaden their product portfolio as well as regional footprint. At present, market players are investing in R&D activities to come up with cutting-edge technologies. For instance,

- Schultz Optical Co. Inc. has rolled out dental surgical loupes that offer 25% larger viewing field compared to others, and up to 5.5x magnification, as well as are lightweight, making dental surgeries extremely easier compared to conventional versions.

- SurgiTel has developed two sorts of customized loupes – through-the-lens (TTL) loupes and front-lens-mounted (FLM) loupes. Customized FLM loupes allow re-adjustment of declination angle and field shape as per user requirement.

Want to Know More About Medical Loupes Market?

Future Market Insights, in its new study, provides compelling insights about the medical loupes market that encloses industry analysis for 2015 – 2019 and opportunity assessment for 2020 – 2030. The report offers unbiased assessment on medical loupes market through five different categories – type, lens type, application, sales channel, and region. The global medical loupes market research study delivers insights of pricing by different life cycle analysis, product life cycle, major market trends and technologies that are being utilized in the development of medical loupes as well as their adoption in various end users.

For any Queries Linked with the Report, Ask an Analyst@ https://www.futuremarketinsights.com/ask-question/rep-gb-11128

Medical Loupes Market Report: Scope

|

Attribute |

Details |

| Forecast Period | 2020-2030 |

| Historical Data Available for | 2015-2019 |

| Market Analysis | USD Million for value |

| Key Regions Covered | North America, Latin America, Europe. South Asia, East Asia, Oceania and Middle East & Africa (MEA) |

| Key Countries Covered | US, Canada, Brazil, Mexico, Germany, UK, France, Italy, Spain, BENELUX, China, Japan, South Korea, India, ASEAN, Australia, New Zealand, GCC Countries, Turkey, Northern Africa, Israel, South Africa |

| Key Segments Covered | Product Type, Lens Type, Application, Sales Channel, and Region |

| Key Companies Profiled | Carl Zeiss Meditec AG, Rose Micro Solutions, L.A. Lens, ErgonoptiX, NORTH-SOUTHERN ELECTRONICS LIMITED, Designs for Vision, Inc., Enova Illumination, SurgiTel, Den-Mat Holdings, LLC, SHEER Vision, R&D Surgical Ltd. (Xenosys) (only indicative list)

|

| Report Coverage | Market Forecast, brand share analysis, competition intelligence, DROT analysis, Market Dynamics and Challenges, Strategic Growth Initiatives

|

| Customization & Pricing | Available upon Request |

Key Questions Answered by the Report

- How the market for medical loupes is expected to shape up in coming ten years?The global medical loupes market size will value around US$ 294.5 Mn in 2020. Market revenue pool will expand by nearly 5.4% CAGR during 2019-2029.

- Which is the largest market for medical loupes?North America and Europe represent the largest market for medical loupes, globally, owing to presence of advanced healthcare expenditure and surging number of surgical procedures.

- How the competition is structured in global medical loupes market?The global medical loupes market is fairly consolidated with presence of various leading players including, Carl Zeiss Meditec AG, Rose Micro Solutions, L.A. Lens, ErgonoptiX, and NORTH-SOUTHERN ELECTRONICS LIMITED.