Future Market Insights (FMI) in a new study has forecast oat milk market’s valuation to reach US$ 435.4 Mn by the end of 2021. Rising focus on sustainable diets that are adequate nutritionally, economically viable, environmentally sound, and socially & culturally accepted has been creating growth opportunities. Currently there is a consistent rise in the demand for plant based dairy alternatives. With the increasing awareness regarding healthy living, an increasing number of consumers have been turning to oat drinks.

Nowadays consumers expect safe and nourishing on-the-go beverages. Increasing prevalence of lactose intolerance has been causing shift to dairy alternatives. Oat drinks contribute to healthy eating habits and provide more nutritional value, including vitamins, minerals, and healthy fats. Many health conscious individuals, opting for restrictive diets and flexitarian diets, have been preferring oat drinks.

Request a Sample Report with Table of Contents and Figures: https://www.futuremarketinsights.com/reports/sample/rep-gb-3308

Oat drinks is beneficial as it carries vitamin D, protein, fiber, calcium. As a result of its nutritional values, oat drinks offers a variety of health benefits, such as reducing cholesterol, boosting immunity, strengthening bone and preventing anemia. FMI has predicted the unflavored or natural segment to hold the lion’s share. However, in the coming years the demand for flavored oat drinks too is expected to rise.

Key Takeaways from the Oat Drinks Market Study

- The global oat drinks market is forecast to rise at nearly 8% CAGR between 2021 and 2031

- In North America, the U.S. will emerge as the leading market accounting for nearly 90% of regional sales in 2021

- The U.K. will emerge as a highly lucrative market, exhibiting nearly 8% Y-o-Y growth in 2021

- France and Germany will remain bright spots for oat drinks sales in Europe

- Australia, Japan, and Korea will continue exhibiting impressive growth at oat drinks market in Asia Pacific

New Product Launches to Fuel Oats Drinks Demand

Looking at the consumers shift towards, manufacturers are engaging in the launch of a wide variety of oat drinks products that have the certification of non-GMO from the regulatory bodies. Lower Packaging Cost, shelf life are some benefits of using flexible and convenient packaging. For Instance:

- Cereal Base Ceba AB (Oatly), manufactures a range of products including oat drinks, oat yogurts and many others. The company also focuses on strategic collaboration with big giants.

- In July 2020, Swedish Oat-milk maker Oatly AB received US$200 Mn investment from Blackstone-Led Group.

- In 2020, Elmhurst Milked Direct LLC has launched new lines in latte drinks and smoothies mixes. This line includes oat latte with two new flavours- cacao oat milk and flash brew oat milk plus two tea flavours- matcha oat milk and golden oat milk.

Who is winning?

A few of the leading players in the Oat Drinks market are Cereal Base Ceba AB, Pacific Foods of Oregon LLC, Elmhurst Milked Direct LLC, Danone S.A., Lima Food SRL, Oatworks, The Hain Celestial Inc., Abafoods s.r.l., Kaslink Foods Oy, Rude Health, Valsoia S.p.A., Earth’s Own Food Company.

Manufacturers are trying to gain customers attention by attractive packaging with creatively crafted and differentiate their beverage from the rest. For instance, Kaslink Aito Foods sells its oat-based goods in recyclable and eco-friendly cartons and advertises this revolutionary packaging it has introduced along with the company to maximize the effect on its customer base. It adds a sustainable business dimension, and adds to its established customer base nature-loving customers. It, in effect, helps to expand the business and improves the oat drinks sales.

Get Valuable Insights into oat Drinks market

Future Market Insights, in its new offering, provides an unbiased analysis of the oat drinks Market, presenting historical demand data (2015-2019) and forecast statistics for the period from 2020-2030. The study divulges compelling insights on the oat drinks market based on Product Type (regular/full fat and reduced fat), By Flavour (natural/unflavoured oat drinks & flavoured oat drinks), By End Use Application (Food Services and Retail Sales) and By Nature (Organic and Conventional), By Format (Shelf-Stabled and Refrigerated) across seven major regions.

Request Complete TOC Of this Report >>> https://www.futuremarketinsights.com/toc/rep-gb-3308

Scope of the Report

| Attribute | Details |

| Forecast Period | 2021-2031 |

| Historical Data Available for | 2016-2020 |

| Market Analysis | USD Million for value and thousand liters for Volume |

| Key Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania Middle East & Africa |

| Key Countries Covered | US, Canada, Germany, U.K., France, Italy, Spain, Poland, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Vietnam, Indonesia, Australia, New Zealand, GCC Countries, Turkey, Northern Africa, South Africa |

| Key Segments Covered | Product Type, Form, End Users, Distribution Channel, Regions |

| Key Companies Profiled |

|

| Report Coverage | Market Forecast, brand share analysis, competition intelligence, DROT analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

Key Questions Answered in the Report

Q1. Which is the most lucrative market for oat drinks globally?

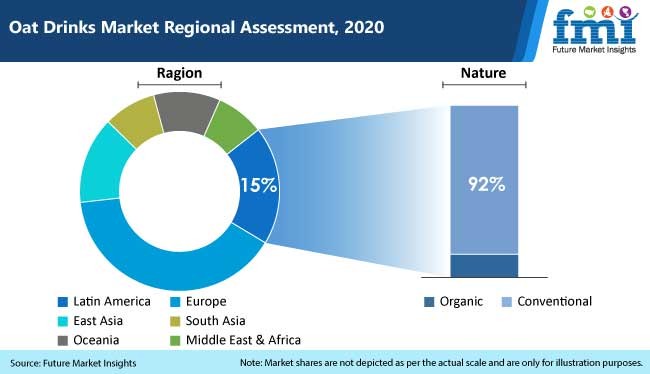

Europe currently leads the global market for oat drinks. Market share of European oat drinks market is 31.4% in 2020. Within Europe, the demand from the U.K. is expected to increase at an accelerated pace in the coming years.

Q2. Which is the top-selling type of oat drinks?

Regular/Full Fat oat drinks are dominating the market and is expected to account for 80% of the market in 2021. Full fat oat drinks have many health benefits such as great for bone health, may lower blood cholesterol and many others, which have been enabling their sales.

Q3. Which end use application account for maximum oat drinks sales?

Retail sales held the maximum market share of 82.7% in 2020. Buyers have several options to make purchase from under retail sales. These include hypermarkets/supermarkets, convenience stores, mass grocery stores, and others.