The role of metalworking fluids in large scale manufacturing is instrumental as their use ensures a longer life and operational efficiency of metal surfaces and components. Over the years, however, manufacturing processes have been remodelled to avoid occurrence of mechanical abrasion that ends up overheating and scarring metal surfaces. Adoption of such non-abrasive machineries is lowering the need for metalworking fluids. As the demand for metal lubricants or coolants diminishes, metalworking fluids are losing out on their industrial applicability. On the account of such factors, a latest report published by Future Market Insights projects that the global market for metalworking fluids will expand moderately at 3.4% CAGR towards the end of 2026.

According to Future Market Insights‘ report,

- In 2016, around 2,473,987 metric tonnes of metalworking fluids were sold across the globe

- This number is likely to cross just over 3,400,000 metric tonnes during the decade-long forecast period and showcase a 3.2% CAGR

- The global market for metalworking fluids, which is presently valued at US$ 9 Bn, is likely to reach US$ 12.6 Bn by 2026-end

- The market is anticipated to face major challenge from rising adoption of newer processes that require lesser or fluids in machining

- Stringent regulations regarding disposal of waste metalworking fluids will also curb their production and impact the business of manufacturers

Request a Sample Report with Table of Contents: http://www.futuremarketinsights.com/reports/sample/rep-gb-517

The report, titled “Metalworking Fluids Market: Global Industry Analysis and Opportunity Assessment, 2016-2026,” has profiled leading companies in the global metalworking fluids market. These manufacturers of metalworking fluids are likely to bear the brunt stringent environmental regulations and laws that prevent the use of such fluids due to the hazardous effects upon exposure. Companies such as Apar Industries Ltd, BP plc, China Petroleum & Chemical Corporation (Sinopec Group), The Dow Chemical Company, Exxon Mobil Corporation, Fuchs Lubricants (a Fuchs Petrolub SE Subsidiary), Houghton International (a Gulf Oil Company), Huntsman Corporation, Idemitsu Kosan Co., Ltd., Quaker Chemical Corporation, and Total SA, are expected to remain prominent metalworking fluids suppliers through 2026.

The report also reveals that North America and the Asia-Pacific excluding Japan region will be at the forefront of market expansion. The demand for metalworking fluids will be higher in these two regions, revenues from which will procure more than 60% share of the global revenues. The report has also identified transportation equipment industry as the largest end-use industry for metalworking fluids. In 2017, over US$ 4 Bn worth of metalworking fluids is anticipated to be consumed for lubricating transportation equipment. Metal fabrication will also remain a key end-use of metalworking fluids, but will incur a marginal dip in its global market value share towards the latter half of the forecast period.

Preview Analysis on Global Metalworking Fluids Market Segmentation By Category – Straight Oil, Emulsified Oil, Semi Synthetic, Synthetic; By Product Type – Removal Fluids, Protection Fluids, Forming Fluids, Treating Fluids; By End Use – Fabricated Metal Products, Machinery, Metal Use, Transportation Equipment and Others: http://www.futuremarketinsights.com/reports/metal-working-fluids-market

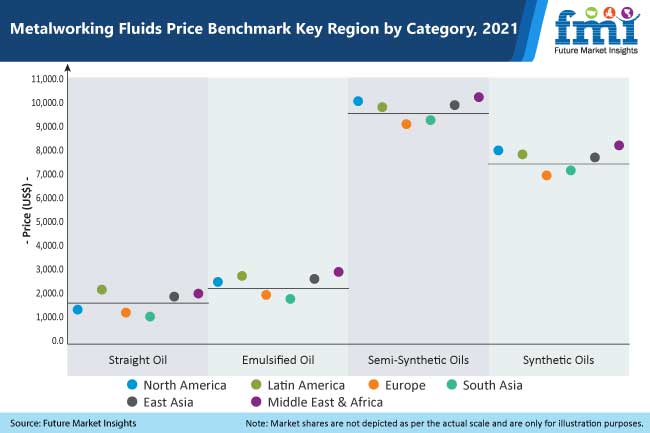

Besides, the moderately growing market has also been segmented on the basis of fluid categories. The report estimates that in 2017 and beyond, revenues from sales of straight oil metalworking fluids and synthetic metalworking fluids will have surpassed US$ 6 Bn. Similarly, the demand for removal and forming metalworking fluids will be considerably high through 2026. Collectively, revenues from global sales of removal fluids and forming fluids will have procure nearly 80% share of global market value by 2026-end.

Competitive Landscape

The global metalworking fluids market is highly competitive, with key players accounting for about 50% of the total market share. Key market participants are targeting high-growth regions like North America for investments owing to high end-use demand and high energy consumption rate. Moreover, key manufacturers are engaging in mergers, acquisitions and collaborations to expand their global footprint in the market. For instance:

- In 2021, Idemitsu announced the beginning of its lubricant business in Pakistan through its subsidiary Idemitsu Lube Pakistan Co. Ltd. The new subsidiary aims to expand the company’s geographic presence.

- In 2021, Shunichi Kito, the CEO of Idemitsu Kosan Co., Ltd., announced the commencement of production and operation at its Huizhou plant in China.

- In 2021, Idemitsu and IHI Corporation announced that they had concluded a joint agreement to establish a supply chain network for ammonia.

- In 2019, Quaker acquired the operating divisions of Norman Hay plc, which is a UK-based specialty chemicals, operating equipment, and service provider to industrial end-markets.

- In 2021, Quaker Chemical Corporation announced the beginning of a new joint venture with Grindaix GmbH, which is a German provider of high-tech coolant control solutions and delivery systems.

Metalworking Fluids Market by Category

By Category:

- Straight Oil

- Emulsified Oil

- Semi-Synthetic oils

- Synthetic Oils

By Product Type:

- Removal Fluid

- Protection Fluids

- Forming Fluids

- Treating Fluids

By End-Use:

- Metal Fabrication

- Heavy Machinery

- Transportation Equipment

- General Manufacturing

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia Pacific

- Middle East and Africa