Future Market Insights (FMI), an ESOMAR-certified market research and consulting firm, has published an updated edition to its widely cited report on the global dredging market. The study revises its earlier forecast on dredging market growth, readjusting key indicators for COVID-19 impact. Downturns are largely attributed to volatility in the oil & gas sector, a key end-use industry for dredging projects. However, government efforts to address flooding problems in coastal areas and low-lying plains is likely to keep dredging projects demand sustained in the long-term.

Furthermore, efforts to sustain global trade volumes to reinvigorate the economy is providing much-needed stimulus to the market.

Request a FREE Sample of this Report in PDF: https://www.futuremarketinsights.com/reports/sample/rep-gb-4821

Key Takeaways

- High urbanization rate across emerging economies to fuel dredging projects in the long run

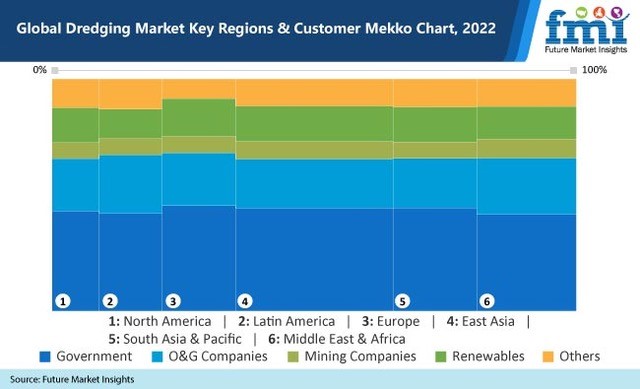

- Government agencies to comprise over 40% of the dredging equipment customer base

- Adoption of innovative equipment monitoring technologies such as smart virtual software growing

- East Asia to emerge as the largest market, expanding at over 4% CAGR

- Trade maintenance to be key application area, accounting for 3 out of 10 projects through 2030.

“Rising concerns over possible environmental damage is prompting dredging corporations to collaborate with governmental and private players to develop eco-friendly approaches to expand their projects,” concludes an FMI analyst.

Request a Complete TOC of this Report with figures: https://www.futuremarketinsights.com/toc/rep-gb-4821

COVID-19 Impact Insights

The COVID-19 pandemic has resulted in an unprecedented recession which is expected to influence the dredging market size to a large extent. Massive production crunches across the oil & gas and tourism sectors are adversely impacting the dredging market.

As the pandemic spread, the grounding of airplanes and automobiles led to a massive downswing in the transportation sector. This resulted in an abrupt demand shock across the oil and gas industry, compelling oil producing giants to cease production, leading to a glut in product inventories.

Fortunately, recent months have witnessed a shoring up of oil prices. Still, OPEC+ countries have curbed supply, with cuts amounting to 7.7 million barrels per day prevailing until December 2020. Such downswings are impacting dredging projects throughout the entire world.

The present-day slump in oil prices is akin to the 2008 financial crisis. Possible recovery is anticipated in 2021 or 2022, restoring prices to pre-crisis levels of US$ 50-60 per oil barrels. This projected favourable outlook is likely to restore prospects for the global dredging market, as companies are expected to resume exploration projects.

Competitive Landscape

The global dredging market comprises of numerous regional and global vendors, rendering the market highly competitive. Players rely on strategic alliances, joint-ventures and development of technologically advanced solutions to penetrate lucrative markets.

In 2019, Jan De Nul Group initiated maintenance dredging works in Nieuwpoort, Belgium. This project was part and parcel of the company’s commitment to reduce CO2 emissions by 15%. To achieve this, it incorporated renewable biofuel from sustainable waste flows.

In October 2020, Royal Boskalis Westminster N.V secured multiple dredging contracts across Germany worth € 45 million from a host of regional maritime transport vendors. These contracts aim to provide flood protection, construction of a shipping fairway and port maintenance across numerous locations.

Key Segments

Application

- Trade Activity

- Trade Maintenance

- Energy Infrastructure

- Urban Development

- Coastal Protection

- Leisure

Customer

- Government

- O&G Companies

- Mining Companies

- Renewables

- Others

Ask us your Any Queries About this Report: https://www.futuremarketinsights.com/askus/rep-gb-4821

Region

- North America (U.S & Canada)

- Latin America (Brazil, Mexico, Argentina & Rest of Latin America)

- Europe (Germany, Italy, France, U.K., Spain, BENELUX & Rest of Europe)

- East Asia (China, Japan & South Korea)

- South Asia & Oceania (India, Thailand, Malaysia, Singapore, Australia & New Zealand and Rest of South Asia & Pacific)

- Middle East & Africa (GCC, South Africa, Nigeria, Israel & Rest of MEA)

More Insights on the Dredging Market

Future Market Insights provides a comprehensive overview on the global dredging market, including a historical forecast from 2015 to 2019 & opportunity assessment from 2020-2030. The study provides compelling insights on the global dredging market on basis of application (trade activity, trade maintenance, energy infrastructure, urban development, coastal protection & leisure) and customer (government, O&G companies, mining companies, renewables & others) across six major regions.