ESOMAR-certified consulting firm Future Market Insights (FMI) has recently published a report on the global ceiling tiles market for the forecast period 2021-2031. According to the report, the market is expected to post impressive gains, expanding staggeringly at a CAGR exceeding 10% throughout the forecast period. Increasing construction and infrastructure development activities are spurring demand.The global ceiling tiles market size was estimated at USD 5.93 billion in 2020. It is expected to expand at a compounded annual growth rate (CAGR) of 8.8% from 2021 to 2031.

The market posed some lucrative gains in the historical forecast, surpassing US$ 26 billion in revenue as of 2018. Residential and commercial construction industries remain primary application areas for ceiling tiles. Modern ceiling tiles are also equipped with features such as acoustic and thermal insulation, attributes which shall greatly enhance prospects for key manufacturers.

A major trend gripping the ceiling tiles landscape is the drive towards attaining sustainability in construction. The advent of green buildings is a notable development in this regard, with key players emphasizing on attributes including sustainably sourced raw material as well as using recycled substances to manufacture their products. For instance, Celiume Tiles use 75% less raw material during the manufacturing process, and produces 98% post-industrial recycled tiles.

Request a Complete TOC of this Report with figures: https://www.futuremarketinsights.com/toc/rep-gb-11097

Key Takeaways from FMI’s Ceiling Tiles Market Study

- Mineral fiber/gypsum ceiling tiles to accounted for over two-fifths revenue share in 2020

- Commercial applications to account for over nine out of ten sales through 2021 and beyond

- By installation, drop/suspended ceiling tiles to enjoy heightened demand in forthcoming years

- By form, laminated ceiling tiles are expected to surge in popularity, amid their ease of installation on light weight

- US to generate attractive growth prospects, underpinned by a flourishing housing sector

- Stringent government regulations to periodically upgrade ceiling material to spearhead UK market growth

- Growing infrastructure development projects to spur sales across India and China

“Mounting environmental concerns are prompting key construction companies to incorporate environmentally-friendly ceiling tiles, providing ample opportunities for manufacturers to expand their product lines,” remarks the FMI analyst.

Competitive Landscape

Prominent manufacturers are effectively deploying a slew of expansion strategies, ranging from customized product offerings to collaborations, mergers and other capacity expansion initiatives. The market is highly competitive, given the presence of a wide range of regional and global level players.

In October 2020, CertainTeed launched its Unified Ceilings Solution, a newly realigned ceilings resource focused on the commercial architecture and design industry. The initiative unites the full ceiling and wall product portfolios of CertainTeed, Hunter Douglas, Ceiling & Wall Products, Norton Industries and Decoustics under the umbrella of CertainTeed Architectural.

In March 2021, Rockfon LLC launched its loyalty program for suspended ceiling installers titled MyRockfon through which loyalty club members can earn rewards while purchasing Rockfon products, complete surveys or share photos of their projects. This will provide the company with an opportunity to show that their products are for everyday projects across all sectors, including shops, offices, restaurants and leisure facilities.

Download Your Sample Copy of This Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-11097

More Insights on the Global Ceiling Tiles Market

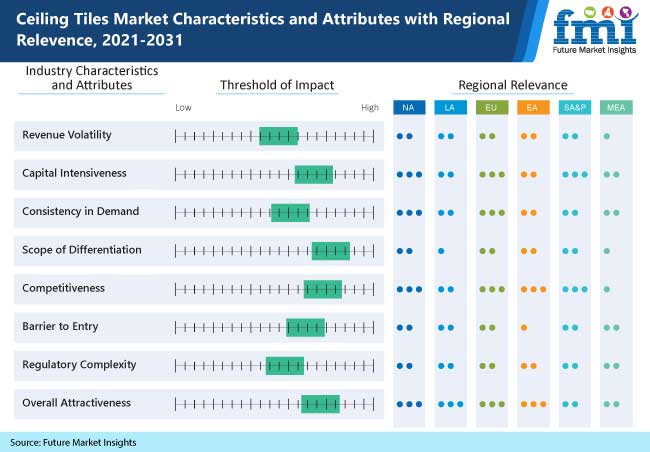

In its latest report, FMI offers an unbiased analysis of the global ceiling tiles market, providing historical data for the period of 2016-2020 and forecast statistics for the period of 2021-2031. In order to understand the global market potential, its growth, and scope, the market is segmented on the basis of material (aluminum, fiber glass, PVC, mineral fiber/gypsum, wood and steel), application (residential, commercial, hospitality, industrial and institutional), installation (surface mount and drop/suspended) and form (laminated, fissured, patterned, plain, textured and coffered) across five major regions (North America, Latin America, Europe, Asia-Pacific and Middle East & Africa)

Key Segments Covered

Material

- Aluminum

- Fiber Glass

- PVC

- Mineral Fiber/Gypsum

- Wood

- Steel

Application

- Residential

- Commercial

- Hospitality

- Industrial

- Institutional

Installation

- Surface Mount

- Drop/Suspended

Form

- Laminated

- Fissured

- Patterned

- Plain

- Textured

- Coffered

Region

- North America (US and Canada)

- Latin America (Brazil, Mexico and Rest of Latin America)

- Europe (Germany, UK, France, Spain, Italy, Russia, BENELUX and Rest of Europe)

- Asia-Pacific (China, Japan, India, ASEAN, Australia & New Zealand and Rest of APAC)

- Middle East & Africa (GCC, Northern Africa, South Africa, Turkey and Rest of MEA)

About Chemicals & Materials division of FMI

The Chemicals & Materials division at FMI offers distinct and pin-point analysis about the chemicals & materials industry. Coverage of the chemicals and materials market extends from commodity, bulk, specialty and petrochemicals to advanced materials, composites, and nanotechnology. The team also puts special emphasis on ‘green alternatives’, recycling and renewable technology developments, and supply-demand trade assessment. Our research studies are widely referred by chemical manufacturers, research institutions, channel partners, and government bodies for developing – ‘The Way Forward’.