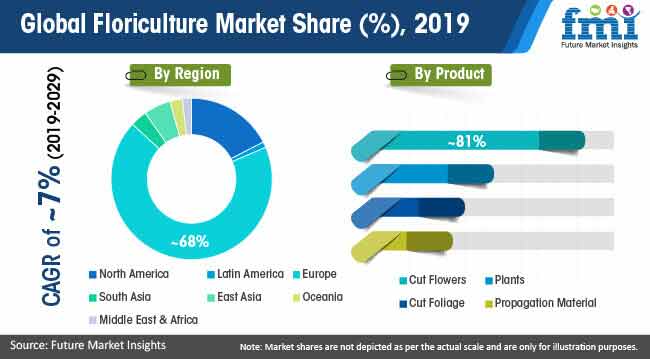

Global revenue from floriculture is projected to supersede the valuation of US$ 43.2 Billion, registering a robust annual growth rate of 7.0 percent, in 2019. Future Market Insights (FMI), in its newly published market intelligence outlook, highlights extensive demand for floriculture—an important activity in agro-business, specifically in Asian and Southeast Asian markets, considering favorable climatic conditions. Scope for floriculture in developing economies is anticipated to flourish as a mainstream occupation, majorly dominated by small and medium-sized enterprises. Moreover, low-cost maintenance including low labor costs in developing countries is also a critical factor contributing to the growth of the floriculture industry.

“The scope for floriculture is expected to remain promising, ranging from seeds and tissue cultures to as single cut flowers, bouquets, potted flowers, potted plants—use as decorative and ornamentals. Small and medium enterprises, which majorly dominate the floriculture landscape, have significantly benefitted from a well-developed virtualized freight and logistics network and a well-coordinated supply chain, comprising growers, auctions, traders, logistics service providers, and gift shop outlets. These virtual networks also enable cost-effective and speedy deliveries of floriculture products, specifically cut flowers, considering their fast deteriorating rate after harvest”, explains a senior CPG domain analyst at the company

Request a Sample Report with Table of Contents and Figures: https://www.futuremarketinsights.com/reports/sample/rep-gb-7855

Regional Outlook Analysis: Floriculture Market

Diverse agro-climatic conditions in Asia-Pacific is a key factor responsible to the growth of commercial floriculture in the region—expanding at a robust CAGR through the period of 2019. In addition to local demands, favorable climatic conditions put Asia-Pacific in a relatively advantageous position to export floricultural products to major flower markets worldwide. For instance, member countries of the Asian Productivity Organization (APO) are increasingly making efforts to cater to the domestic and overseas markets as critical issues relating to perishability, seasonality, market volatility, and quality sensitivity remain. Strategies are majorly focused on efficient post-harvest management to ensure top-quality floriculture products in the international market. Japan, the largest consumer, and producer of potted plants and flowers in Asia-Pacific, has developed an efficient market chain. Moreover, a notable quantity of special floriculture products like Bonsai (China/Japan) and Orchids (Thailand) is exported to Europe.

Opportunity Analysis: The floriculture market in emerging nations remains underdeveloped considering the lack of standard regulations to streamline floriculture trade—with supply chain network issues being the most important opportunity pocket. Developing efficient logistics networks in emerging networks is the need of the hour to reduce and eliminate immediate loss or damage of the floriculture products. Implementation of regulatory norms to enable a systemic organization is a must for the growth of the floriculture market in developing markets.

Preview Analysis Global Floriculture Market: Blooming Demand for Floriculture Due to Extended Vase Life Resulting from Biotechnology: Global Industry Analysis (2013 – 2017) & Opportunity Assessment (2018 – 2027): https://www.futuremarketinsights.com/reports/floriculture-market

The floriculture market in Europe is another high revenue-generating region, demonstrating sustained growth in recent years, predominantly attributed to the growing demand for cut flowers in France and Germany, amongst other European Union Nations. Moreover, the Netherlands is projected to remain a leading exporter of bulbs and cut flowers.

Improving Floriculture Landscape through Technological Advanced Cultivars

As the demand for floriculture increases, in the coming years, key players in the industry are making racing efforts to meet the consumer demands—through, value-added flowers, which are not just cost-effective but also have unique floral characteristics including longer shelf life and diverse colors and shapes. Floriculture experts are increasingly adopting biotechnological approaches for distinctive floral architecture, fragrance, post-harvest life, and resistance to abiotic stress.

Key players are investing in mutation induction approaches, considering the growing demand for ornamental plants and related species, globally. Furthermore, mutation breeding techniques—for both cut and potted plants, are also being adopted for ornamental plants owing to easy vegetative propagating, enabling the production of induced mutants. Moreover, gamma rays, among mutagens, have been used for the effective development of new varieties in ornamental species. Genetic manipulations are also known to increase the vase life of flowers up to 9 days, along with better floral morphology and disease resistance. As per FMI, effective mutation induction strategies along with other in-vitro culture techniques could drive the sales of ornamental horticulture, especially floriculture.

Key Segmentation Insights Drawn from Floriculture Market Report

- In terms of product type, cut flowers will gain significant prominence, representing a market share of approximately 79 percent through the forecast market.

- By flower type, revenue from the Rose segment is estimated to exceed US$ 24 Billion in 2023, taking a significant revenue leap from its market position in 2018.

- In terms of end-use, FMI forecasts the institutions/events segment to witness increased applicability of floriculture products.

- Sales of floriculture products through direct channels will push more revenue in the market. However, the emergence of online retailers considering flourishing virtual supply networks will also pump significant revenue in the floriculture market— the segment representing a colossal CAGR of 14.3 percent through 2027. Europe is expected to remain the largest revenue contributor under this segment.

Our advisory services are aimed at helping you with specific, customized insights that are relevant to your specific challenges. Let us know about your challenges and our trusted advisors will connect with you: https://www.futuremarketinsights.com/askus/rep-gb-7855

Competitive Landscape Analysis of Global Floriculture Market

In its comprehensive report on the global dynamics of the floriculture market, FMI has also tracked the competition in the aforementioned market—with the international players holding a lion’s share of over 65 percent, contributing approximately US$ 24.6 Billion to the global floriculture market. High production capacity and implementation of improved technologies to produce a wide variety of floriculture species will place the international players in a dominant position. Easy availability of such products will place also place the local players in a prominent position within the supply chain—holding 25 percent of the market share. Moreover, unorganized retail outlets will also contribute to the growth of local players. Tie3-3 players including Verbeek Export B.V., Dos Gringos, LLC, and The Flamingo Group are projected to hold roughly 10 percent of the total market share. As a part of their differentiation strategy, tier-3 players are projected to enhance the supply chain network.

FLORICULTURE MARKET TAXONOMY

The global floriculture market is segmented in detail to cover every aspect of the market and present complete market intelligence to readers.

Product

- Cut Flowers

- Cut Foliage

- Plants

- Propagation Material

Flower

- Rose

- Chrysanthemum

- Tulip

- Lily

- Gerbera

- Carnations

- Texas Bluebell

- Freesia

- Hydrangea

- Others

End Use

- Personal Use

- Institutions/Events

- Hotels, Resorts, & Spas

- Industrial

Sales Channel

- Direct Sales

- Specialty Stores

- Franchises

- Florists & Kiosks

- Supermarkets/Hypermarkets

- Independent Small Stores

- Online Retailers

- Other Sales Channel

Region

- North America

- Latin America

- Europe

- East Asia

- South Asia

- Oceania

- Middle-East and Africa